In Latin America and the Caribbean (LAC), more than 100 million people in the region are estimated to live in urban slums. Tackling poverty, inequality, and social exclusion are some of the region’s most pressing challenges, but efforts are threatened by disruptive natural events and lack of funds for social support.

In Latin America and the Caribbean (LAC), more than 100 million people in the region are estimated to live in urban slums. Tackling poverty, inequality, and social exclusion are some of the region’s most pressing challenges, but efforts are threatened by disruptive natural events and lack of funds for social support.

Over the last few years, limited economic development and more frequent extreme weather events have made existing risks worse and uncovered new risks.

About 70 percent of LAC cities are at high risk of experiencing natural disasters that can critically affect residents and infrastructure. In the near future, natural disasters may reduce regional GDP up to 9.4 percent (worse than the Covid-19 pandemic) and increase financial risk due to governments’ borrowing for emergency response.

About 70 percent of LAC cities are at high risk of experiencing natural disasters that can critically affect residents and infrastructure. In the near future, natural disasters may reduce regional GDP up to 9.4 percent (worse than the Covid-19 pandemic) and increase financial risk due to governments’ borrowing for emergency response.

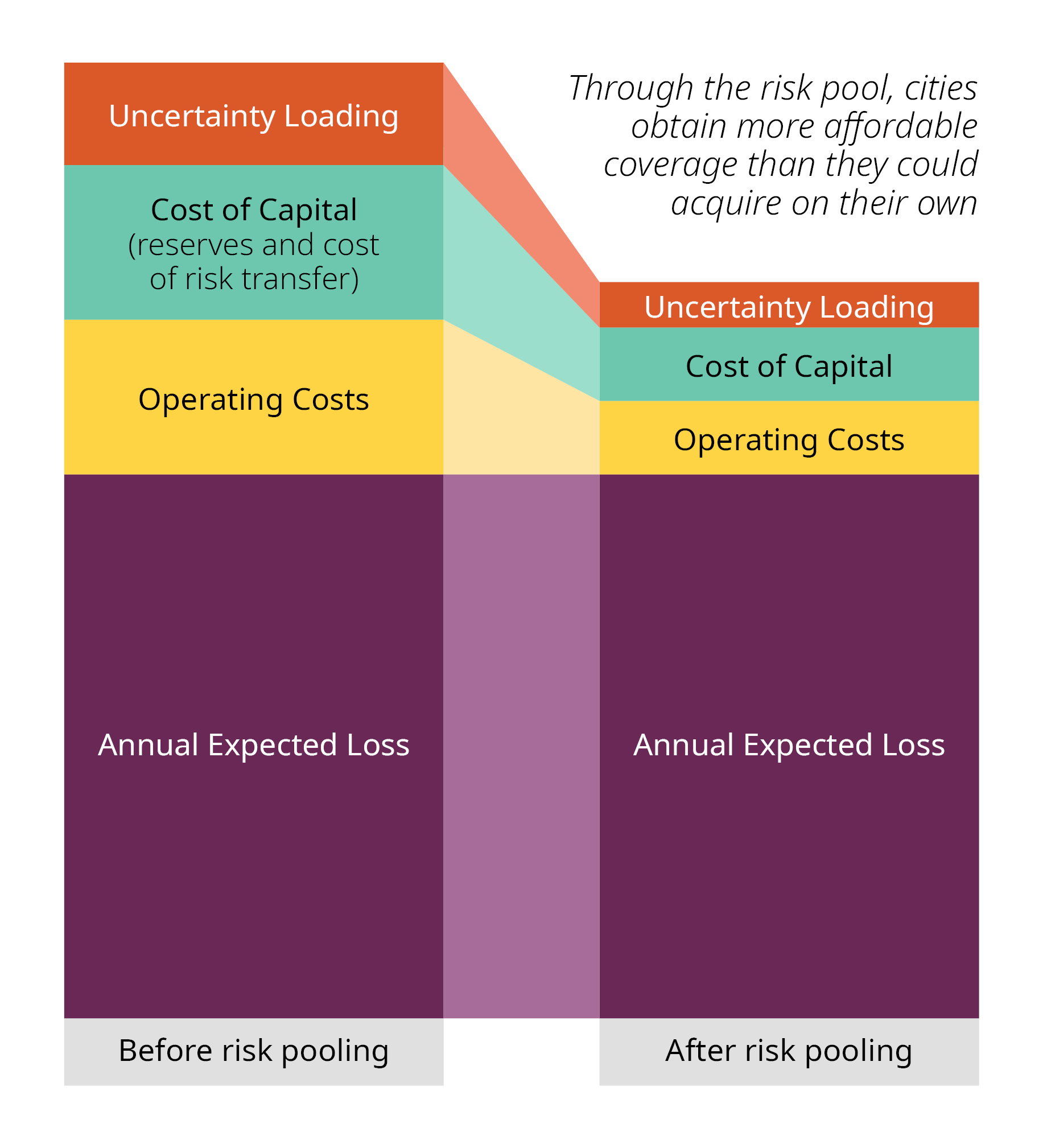

Urban insurance could help balance a city’s budget following a damaging disaster, yet adoption of these products in the LAC region remains low. Insurance premiums and market availability are the two biggest barriers to a city purchasing natural disaster insurance.

In Latin America and the Caribbean (LAC), more than 100 million people in the region are estimated to live in urban slums. Tackling poverty, inequality, and social exclusion are some of the region’s most pressing challenges, but efforts are threatened by disruptive natural events and lack of funds for social support.

In Latin America and the Caribbean (LAC), more than 100 million people in the region are estimated to live in urban slums. Tackling poverty, inequality, and social exclusion are some of the region’s most pressing challenges, but efforts are threatened by disruptive natural events and lack of funds for social support. About 70 percent of LAC cities are at high risk of experiencing natural disasters that can critically affect residents and infrastructure. In the near future, natural disasters may reduce regional GDP up to 9.4 percent (worse than the Covid-19 pandemic) and increase financial risk due to governments’ borrowing for emergency response.

About 70 percent of LAC cities are at high risk of experiencing natural disasters that can critically affect residents and infrastructure. In the near future, natural disasters may reduce regional GDP up to 9.4 percent (worse than the Covid-19 pandemic) and increase financial risk due to governments’ borrowing for emergency response.